The Spirit of St. Louis Fund continues to be active in the Midwest, with Fund I creating 335 jobs and supporting 245% average revenue growth at portfolio companies since inception. Due to the success of Fund I (2018 SBIC), Fund II (2021) was created and quickly filled in the Fall of 2021 to carry on the success of Fund I, as well as meet the capital needs of portfolio companies in the region. Most recently, the Small Business Administration has provided a green light letter for Fund III (SBIC), which is anticipated to complete the application process in Q1 of 2023.

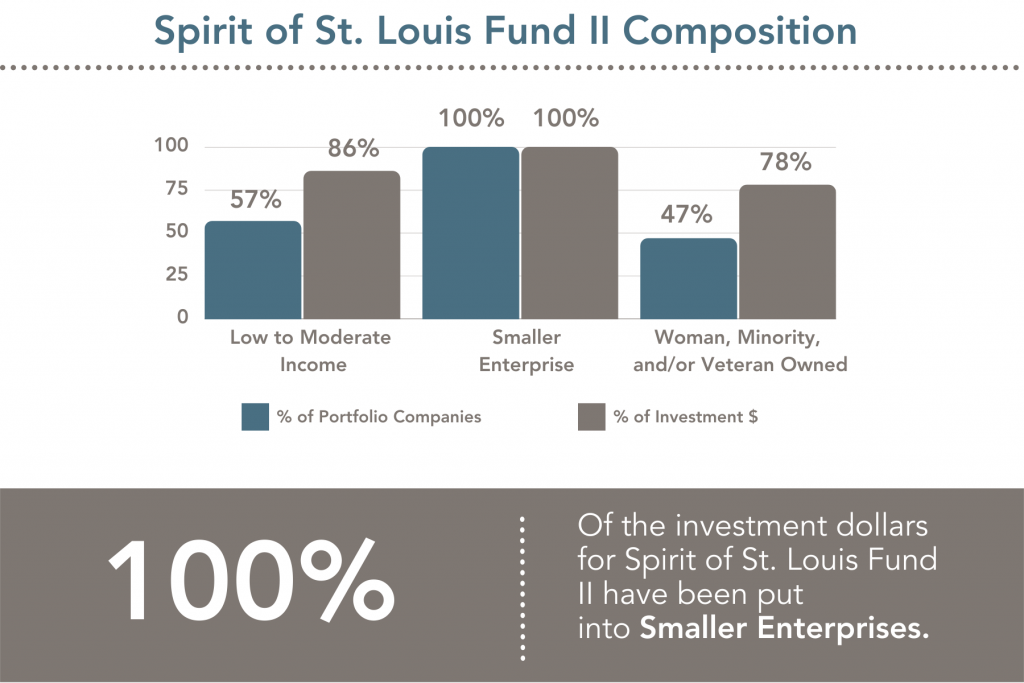

Through Spirit of St. Louis Fund I (2018) and Fund II (2021), partners Cultivation Capital and Twain Financial Partners have continued to promote startups in St. Louis and the Midwest. With a focus on early stage technology companies valued at $1-5 million, the Spirit of St. Louis Fund I has supported revenue growth of over $66 million and creation of 335 jobs at portfolio companies from initial investment to date. The Spirit of St. Louis has also been specifically focused on smaller enterprises in low to moderate income (LMI) areas with over 57% and 86% of Fund I and Fund II dollars, respectively, invested in LMI areas. We believe smaller enterprise, Midwest startups represent an underserved segment of the market with similar potential to coastal startups. We have seen the support from the Spirit Funds draw out this potential as our portfolio companies have continued to grow and raise capital. The Spirt of St. Louis is also mindful of the woman/minority/veteran owned startups that also continue to be underserved. In Fund I and Fund II, 64% and 78%, respectively, of dollars invested from the Fund have gone to woman/minority/veteran owned businesses. The support provided by the Spirit of St. Louis Funds to woman/minority/veteran owned businesses is crucial to their success and continued growth.

Click here to learn more about our venture capital investments.