Twain Financial Partners announced the successful financing of ground lease capital in connection with the renovation and conversion of a hotel in Grand Rapids, Michigan.

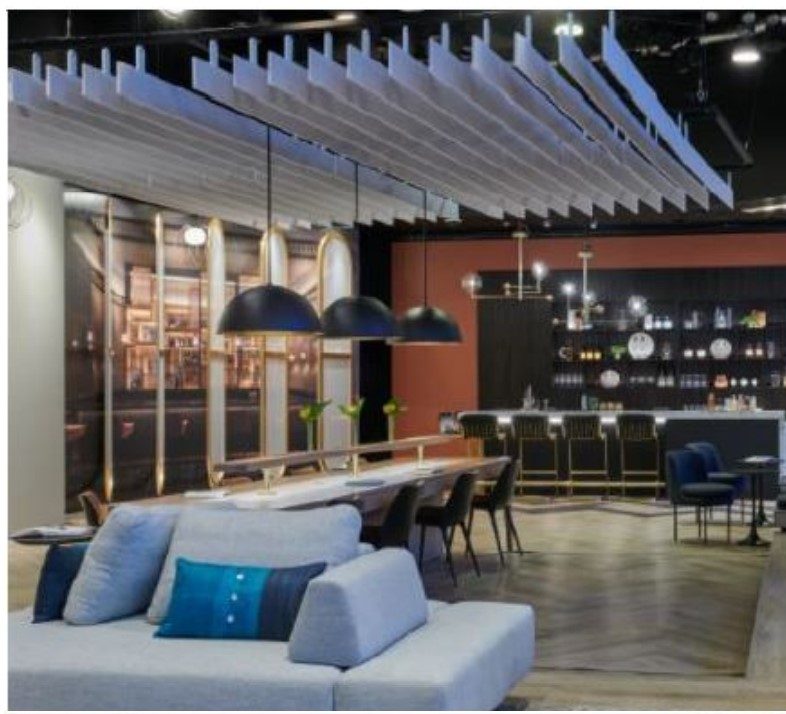

Twain’s funding will provide state-of-the-art improvements to the hotel, which will be rebranded to a Sheraton by Marriott. Upon completion, the hotel will feature 246 updated guest rooms, a new 200-seat restaurant and lounge, a 75-seat pool bar, indoor/outdoor pool, indoor jacuzzi and 20,780 square feet of meeting space. Additionally, the hotel will offer shuttle services to the nearby Gerald R. Ford International Airport and have the second largest conference and meeting space in Grand Rapids.

HDDA serves as developer and asset manager on this project. HDDA is a hotel development and disposition advisory firm with a current portfolio mix of hotels and loans.

“We are excited to invest in Grand Rapids and renovate the hotel to best fit the demands of the market,” said Rob Rothschild, President at HDDA. “The sale-leaseback structure provides us with a non-recourse financing option to capitalize the renovation, while at the same time allowing us to maintain flexibility to execute on the business plan. Of all the options we evaluated, Twain best understood our needs and was able to craft creative solutions that worked for our capital.”

“Twain is proud to be a part of this transaction,” said Erik Lintvedt, Business Development Officer at Twain. “The renovation of the old Crowne Plaza is long overdue and promises to unlock significant value for an important asset to the Grand Rapids community. Moreover, the project showcases HDDA’s and Twain’s effectiveness in financing hospitality assets in a challenging environment. We appreciate the partnership with HDDA and look forward to our next opportunity with them.”